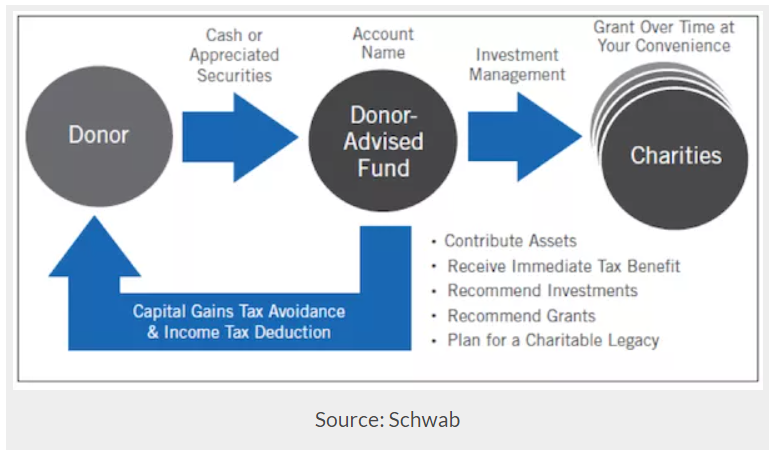

This is a dumb situation that must be stopped. Currently, a private, tax-exempt foundation can meet their financial obligations for giving (5% of equity) by donations to their own Donor Advised Funds (DAF), which presently does not have to give funds away at all. Under the current system, money can sit in the DAF for years before it is spent, even though the donor already received a tax break. If the intention of offering tax exemption to a foundation is to provide a tax benefit to the person who established it, then this system works very well. But my understanding is that foundations get tax exemptions so the money can be redirected to do good in the world.

Since 2007, contributions to donor advised funds grew from 4% to 13% of the total amount of individual giving as of 2018. That rivals the contributions to private foundations which accounted for 15% of the value of individual giving as of 2018.

The “payout rule” refers to the fact that, by law, private foundations must distribute 5% of the value of their net investment assets annually in the form of grants or eligible administrative expenses. I would like to see DAFs be brought up to the 5% payout rule by 2022, then both groups should increase their payouts over the subsequent years, possibly 7% in 2023 and 9-10% in 2025.

This rule was created to prevent foundations from receiving assets, but never actually making charitable distributions with them. DAFs need to be held to the same rules.

At Segal Family Foundation (SFF) and Focus for Health (FFH), we spend a great deal of time looking for grantees that care about people and try to improve the quality of life for many. In Sub-Saharan Africa, SFF has over 300 grantees and 12 people on the ground in Africa. These foundations heavily exceed the 5% payout rule, and we take pride in what these foundations accomplish.

It is important that wealthy people use their wealth intelligently to make better lives for all. It is also important that the IRS and government only offers tax-exemptions to entities that are spending the money to address charitable causes. DAFs should be abiding by the same rules as foundations.

Thank for supporting the vulnerable.

May God bless you abundantly for your selfless and kind heart.

We have more Ugandan children and women in need of your support. Kindly support us.